Banking on Micro-Investing

Now more than ever, banks are under pressure, as the competitive landscape changes in Australia. Challenger banks and Fintechs are acquiring customers through aggressive growth strategies and tailored products to younger generations.

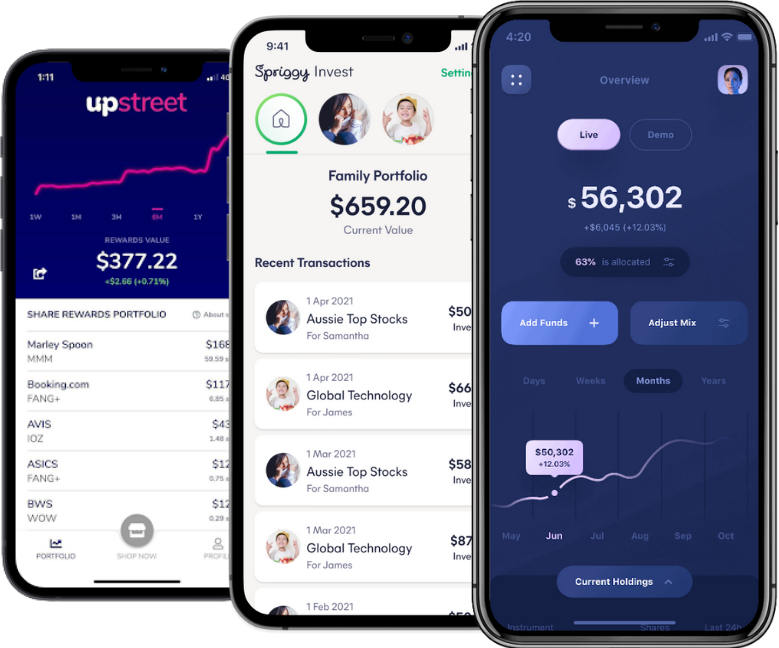

The industry has evolved from chequing accounts and credit cards to mobile banking, Apple Pay, roundups and BNPL. As customers increasingly demand innovative products to help them save and invest money, micro-investing will quickly become a mainstay of the retail banking offering.

If you are interested in reading more, download the report.

Download Report

How Cache Invest benefits you

01

Speed to market

02

Eliminate compliance risk

03

No tech development required

Simply connect to Cache’s platform through modern APIs

04

Manage all data in a central location

Utilise Cache’s systems to manage all customer interactions

05

A fraction of the cost

Benefit from Cache’s economies of scale in creating investment products

06

A platform built for enterprise

07